Tata Motors, one of the largest carmakers in the country, saw its shares dip on Thursday, March 13. This came to pass after the company shares zoomed by over 3 per cent in the previous trading session on Wednesday.

JLR’s EV Plans

The Mumbai-based company previously assured progress on the Jaguar Land Rover or JLR, after the company closed its plans to build EVs in its Tamil Nadu plant.

After the reassurance from the company, the Tata Motors shares rose on Wednesday. However, the developments took a different course on Thursday, as the company shares slipped beyond 2 per cent.

The tale of Jaguar Land Rover and Tata has been complicated one. Many rating agencies in the past, have raised doubts over the company, and its potential to deliver. Jaguar Land Rover became a part of the Tata Motors realm in 2008.

JLR is renowned for its high-end premium luxury class vehicles, that has a strong base.

The Natarajan Chandrasekaran-led Tata Motors sold a total of 79,344 units compared to 86,406 last year, marking a year-over-year decline in total sales numbers.

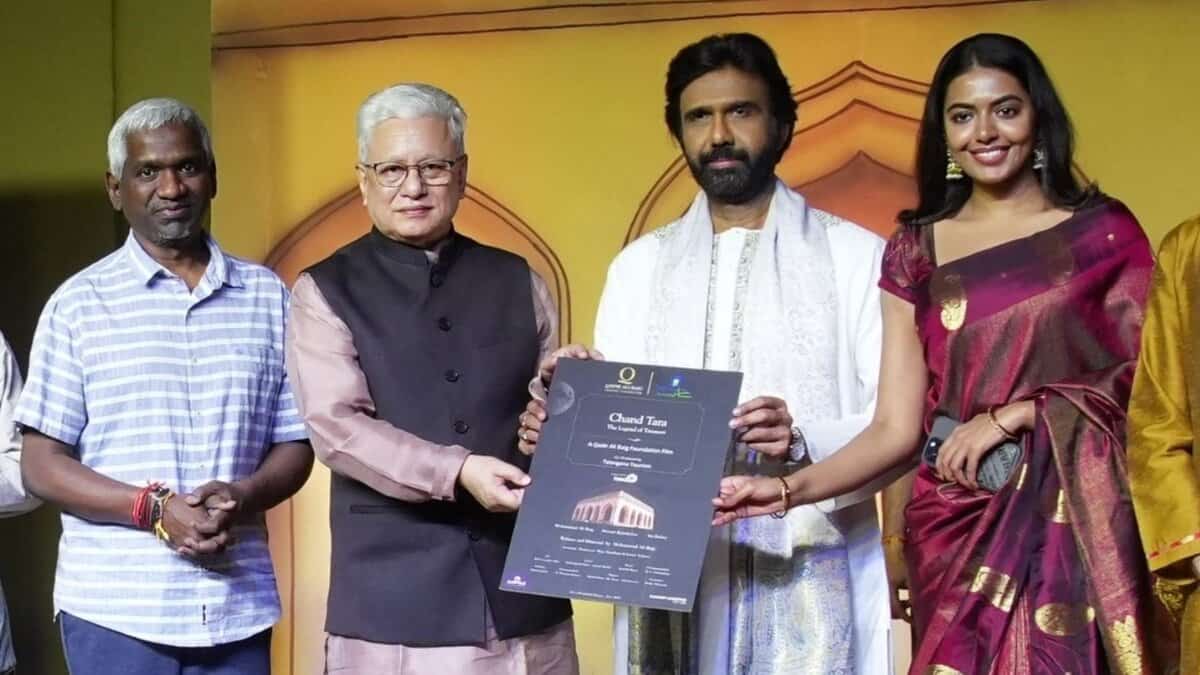

| Representative Image

The Market Slump

The recent decision to shelve the plant is possibly a result of the larger trend witnessed in the electric vehicle market. Over the past year, the demand for electric vehicles has subsided while there has been a rise in demand for hybrid vehicles.

This is not just the case in India, but internationally the demand for pure EVs has dipped. As a result of this, companies like Tesla and BYD have also vied.

In addition to this, Tata also had a relatively underwhelming February, with a decline in monthly auto sales.

The company came in third behind its rival Mahindra & Mahindra.

The Natarajan Chandrasekaran-led Tata Motors sold a total of 79,344 units compared to 86,406 last year, marking a year-over-year decline in total sales numbers.

Tata Motors Ltd

When we look at the state of the company shares on Thursday, the overall decline towards the end of the day’s trading session remained under 2 per cent.

At the time of writing, the company shares dipped to Rs 655.95. This was a result of a decline of 1.85 per cent or Rs 12.35 per share. In the past month of trade, the company shares have seen dip of Rs 27.90 or 4.08 per cent.