Add Techlomedia as a preferred source on Google.

The global smartphone market saw a small recovery in 2025. According to Counterpoint Research, worldwide smartphone shipments grew by 2 percent compared to the previous year. This was the second year in a row with growth, but the pace remained slow. The data suggests that the market is stabilising, not fully bouncing back.

One clear trend in 2025 was the growing interest in premium smartphones. More users were willing to spend extra on higher-priced models. This boost was due to easy financing options and strong marketing. At the same time, 5G phones continued to gain ground in emerging markets, where many users were upgrading from older devices.

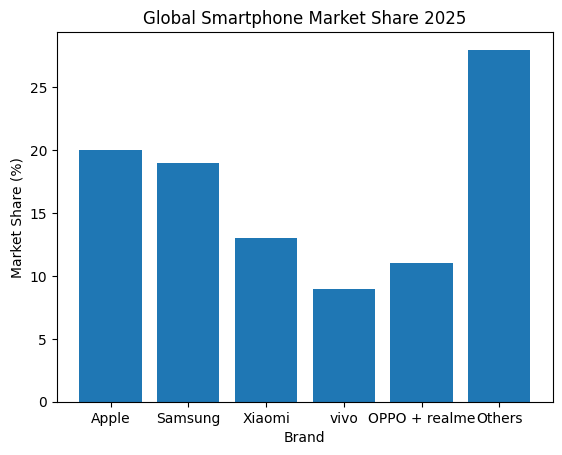

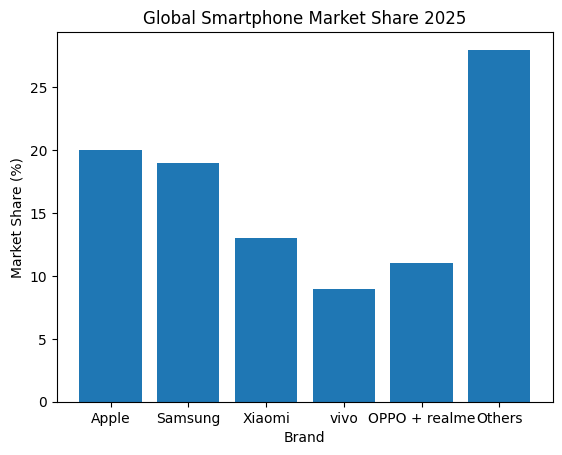

Apple ended 2025 as the market leader. The company captured a 20 percent global share and recorded 10 percent year-on-year growth, the highest among the top five brands. Apple’s performance was not limited to the US or Europe. Demand improved in countries like India, Japan, and parts of Southeast Asia.

The iPhone 17 series helped Apple in the final quarter of the year, while older models like the iPhone 16 continued to sell well. Another factor was the delayed upgrade cycle from the pandemic period. Many users who bought phones during COVID were due for a replacement, and Apple benefited from this.

Samsung took the second spot with a 19 percent market share and 5 percent growth. The Galaxy A series continued to drive volume in the mid-range segment, while the Galaxy S25 and Fold7 helped Samsung stay competitive in the premium space. Samsung did face pressure in regions like Latin America and Western Europe, but strong demand in Japan and steady performance in core markets helped balance things out.

Xiaomi remained in third place with a 13 percent share. The brand managed to hold its ground despite tough market conditions. Its focus on offering premium features at lower prices worked well in emerging markets. Strong performance in Latin America and Southeast Asia played a key role in keeping shipments stable. However, it is losing grip in India, which used to be its key market. POCO, Xiaomi’s sub-brand, is doing well, but Xiaomi and Redmi brands aren’t meeting expectations. I feel Xiaomi is suffering from brand fatigue.

vivo finished fourth with 3 percent growth in 2025. Its growth was driven by a focused product lineup and strong offline sales, especially in India. OPPO, on the other hand, saw shipments fall by 4 percent. Weak demand in China and heavy competition in the Asia Pacific hurt its performance. Even though OPPO grew in India and parts of the Middle East and Africa, those gains were not enough to cover losses elsewhere. Counterpoint notes that if OPPO and realme are combined, their total market share would be around 11 percent.

Smaller brands also had a good year. Nothing recorded 31 percent growth, while Google grew by 25 percent. Their volumes are still limited, but the numbers show that unique products and strong ecosystems can still attract buyers.

If we talk about the coming months, Counterpoint Research has already revised its 2026 shipment forecast downward by 3 percent. The main reason is a growing shortage of DRAM and NAND memory, along with rising component prices. Chipmakers are increasingly prioritising AI data centers over smartphones, which is putting pressure on supply.

As a result, smartphone prices have already started to rise in some markets. This could slow demand, especially in price-sensitive regions. Apple and Samsung are expected to remain more resilient due to stronger supply chains and their focus on premium segments. Chinese brands that rely heavily on lower-priced devices may face greater pressure if costs continue to increase.

If you look closely at the numbers, 2025 was a year with balanced growth. People are buying fewer phones, but they are choosing better ones when they upgrade. SO, brands need to understand what consumers actually want.

Follow Techlomedia on Google News to stay updated. ![]()

![]()

Affiliate Disclosure:

This article may contain affiliate links. We may earn a commission on purchases made through these links at no extra cost to you.