After three days of gains, the stock market fell sharply. Sensex dropped 1,386 points. |

Mumbai: After rising for three straight days, the stock market saw a sharp fall on Thursday. What started as a positive session quickly turned negative. By around 3:01 PM, heavy selling hit the market.

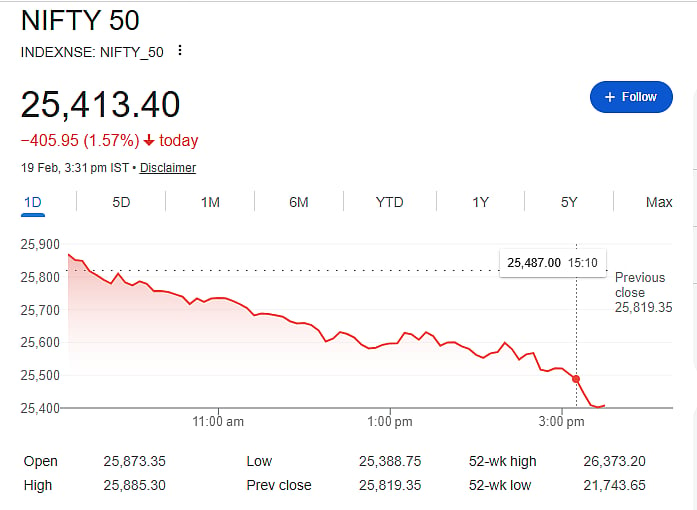

The Sensex crashed nearly 1,386 points, while the Nifty fell about 405 points. Due to this sudden fall, the total market value of listed companies dropped sharply. The market capitalisation declined from Rs 47,174,876.86 crore to Rs 4,64,43,943.53 crore. In this fall, investors lost around Rs 7.30 lakh crore.

Profit Booking After Rally

One of the main reasons for the fall was profit booking. After three days of strong gains, many investors decided to sell shares and book profits. Selling pressure was also seen in midcap and smallcap stocks, which further weakened overall market sentiment.

Focus stays on US-Iran

A fresh wave of global uncertainty has emerged after a CNN report claimed that the US military could launch a strike on Iran as early as this weekend. Separately, Axios reported that any potential US action may not be limited in scope, but could turn into a “massive, weeks-long campaign” resembling a full-scale war.

The developments have put financial markets on alert. Investors across global markets are closely tracking the evolving US–Iran situation, with fears that tensions could escalate further in the coming days.

Market experts say participants are turning cautious and booking profits ahead of the weekend. Many traders are reportedly reducing exposure and taking money off the table to avoid sudden volatility if geopolitical risks intensify.

The uncertainty surrounding possible military action has raised concerns about its impact on oil prices, global trade flows and overall market sentiment. For now, investors remain watchful, with the US–Iran equation firmly in focus.

Rising Crude Oil Prices

Crude oil prices remained high due to fears of rising tension between the US and Iran. Higher oil prices increase costs for many companies and can impact the economy. This created extra pressure on the market.