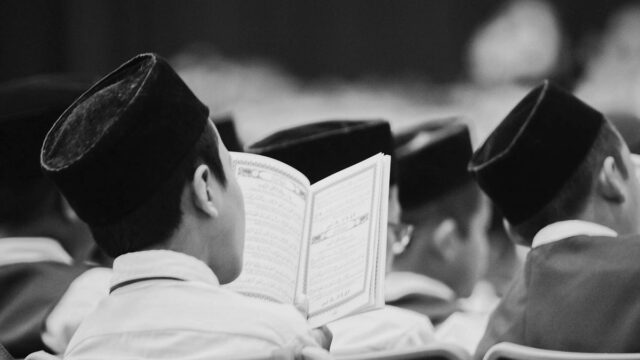

The month of Ramzan, which began on March 1, is a period of prayers, dawn-to-dusk fasting, and charity.

Charity, or zakat, is one of the fundamental pillars of Islam. Every financially independent person has to follow this obligation. Religious laws require believers to accurately calculate, and donate their Zakat in accordance with the principles of Shariah. There are prescribed rules on how to calculate the amount to be donated and who the beneficiaries should be.

Unlike in the past, when believers relied on elders and local religious leaders for advice, there are now multiple online forums that help them do their religious duty. Helplines, WhatsApp-based forums, and other online services provide answers that the local cleric may not provide. The Islamic Centre of India recently launched a ‘Ramadan Helpline’ to assist people with their queries regarding fasting, namaz, and other religious practices during the month. The helpline, operational daily from 2.00 to 4.00 pm, also provides information on zakat.

The Zakat and Charitable Foundation, based in Lucknow, has run a zakat helpline for the last two years. Mohammad Tahir Madne from the group said that the online services make it more convenient for donors to calculate and channel their donations to the right cause. “Earlier, people relied on local alims (scholars) and maulanas. People sometimes have more complex questions that may not be answered satisfactorily. For instance, we have farmers asking us for help in calculating the portion of agricultural produce to keep aside as zakat. Women want to know the zakat they have to pay for the jewelry they own,” said Madne.

Aamir Edresy, president of Mumbai-based Association of Muslim Professionals, which provides a Zakat helpline, said that the Covid pandemic has increased the popularity of online services. AMP has an online ‘Zakat Calculator’, designed to help calculate Zakat instantly. Developed in consultation with religious scholars and our expert technical team, this calculator ensures accuracy and ease of use. “In simple terms, zakat is 2.5% of the wealth, but it is not as simple as that. In India, clergy members would give simple speeches of how to pay it. However, answers to contemporary questions are more difficult to address,” said Edresy.

AMP’s helpline gets queries about zakat on mutual funds, crops, gold, and shares in corporate companies. Shopkeepers want to know if they have to pay zakat on the stocks in their shops. Zubair Azmi, a lawyer, said that the information provided on the online channels is useful. “It gives you appropriate advice. The Koran says that a person who deserve to receive zakat should not ask for it. These forums help you to identify the needy,” said Azmi.