Ola Electric, the largest e-scooter maker in the country, has had fairly tale scenario panning out for it, at Dalal Street, over the past few trading sessions. The company shares zoomed by over 15 per cent, just in the past 2 trading sessions.

Centre Ask Some Tough Questions

This came to pass despite myriad controversies surrounding the Bhavish Aggarwal-led company.

Now, the markets, finally appear to be catching up, the central government, more specifically, the Ministry of Heavy Industries, has now asked the company to issue a clarification on the claims of a mismatch in sales numbers. Bhavish Aggarwal, Ola Chairman and Group CEO on electric scooter

Earlier, reports suggested that there is a major gap between the number of vehicles, that the company claimed it had sold in the previous month, and the total number of registrations, that came to pass the government’s own Vahan portal.

| Ola

The ministry is seeking details on sales and registration data discrepancy.

Earlier, reports suggested that there is a major gap between the number of vehicles, that the company claimed it had sold in the previous month, and the total number of registrations, that came to pass the government’s own Vahan portal.

A Financial Express report said that the company claimed to have sold about 25,000 units of its electric scooter, compared to the 8,600 odd official registrations that were made on the government portal.

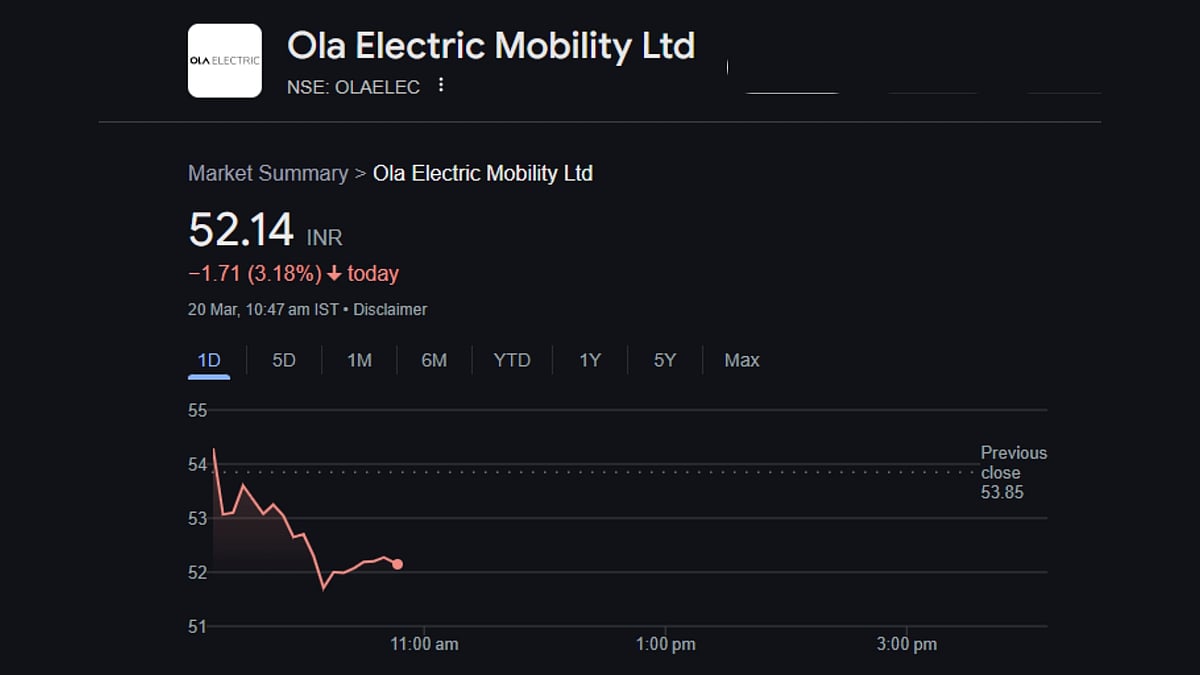

Ola Electric Shares

With official interference, investors seem to be looking to take the heat of their resources from the controversy-ridden stocks.

When we look at the story of the company’s performance at Dalal Street today, it is an interesting one.

The company shares, riding on the previous day’s momentum started on a positive note, at Rs 54.11, higher than the previous day’s Rs 53.85 per piece.

However, the this tale had a twist, as the day progressed further. The company shares dipped to Rs 52.14. This meant a decline of a major 3.18 per cent or Rs 1.71 in its total value, so far.

Whether the trend continues for the remainder of the day’s trade, is something that remains to be seen. The recent surge in company shares have minimized the losses accounted in the past month of trading to 15.51 per cent.