The cost of new energy-efficient home appliances, plug-in electric vehicles and maybe even electricity itself could increase for Minnesotans next year if President-elect Donald Trump and Republicans in Washington, D.C., make good on promises to scale back or end popular clean energy incentives passed during President Joe Biden’s term.

Thousands of jobs in the state’s booming clean energy sector could be at risk, too.

Since 2021, Minnesota has secured at least $12.2 billion in federal award money authorized by the Infrastructure Investment and Jobs Act, CHIPS & Science Act and Inflation Reduction Act, including nearly $3.5 billion in grants for projects intended to slow or adapt to the effects of climate change. And more than 100 clean energy generation and storage projects in Minnesota — representing nearly $11.1 billion in public and private investment and potentially creating more than 10,500 jobs — may be eligible for tax incentives authorized by the IRA, according to the Climate Jobs National Resource Center.

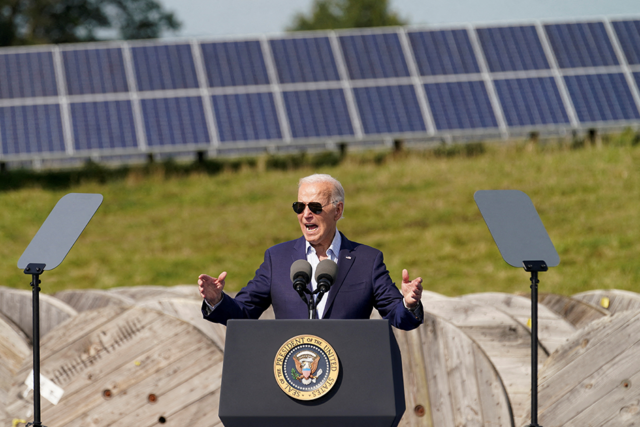

Federal funding authorized during the Biden administration has enabled significant investments in Minnesota manufacturing and infrastructure. But the Biden administration is winding down with tens of billions in awards yet to be finalized as a new president who has vowed to rescind unspent IRA funding prepares to take office.

“Everything is at risk, but particularly the equity-focused programs” like Solar for All, which aims to expand solar energy in lower-income communities, said Logan O’Grady, executive director of the Minnesota Solar Energy Industries Association. “I think we’ll see the Biden administration working really hard in the next month to make sure that money is encumbered.”

Trump’s executive-branch appointees could slow the flow of grants and loans authorized by the IRA while tightening eligibility for its generous clean-energy tax credits, but more significant changes are likely to come as part of a congressional deal to extend the expiring Tax Cuts and Jobs Act beyond 2025, according to energy policy experts on a November panel convened by tax credit marketplace Crux.

For example, the Republican-controlled Congress could repeal the new elective pay rule that allows tax-exempt organizations to claim IRA tax credits along with an IRA provision that has enabled billions in private clean-energy project financing by allowing project developers and owners to sell tax credits to others, federal tax policy expert Jennifer Acuña said on the webinar.

Elective pay “puts our members on a level playing field to get renewable energy tax credits [and would be] a key building block going forward to continue building out renewables” in Minnesota, said Darrick Moe, CEO of the Minnesota Rural Electric Association, which represents 50 member-owned, not-for-profit electric cooperatives operating in Minnesota.

Wind and solar energy

MREA members and end-users benefit from other IRA-enabled initiatives, like the U.S. Department of Agriculture’s New ERA program. Earlier this year, the USDA awarded $579 million to MREA member Dairyland Power Cooperative to procure 1,080 megawatts of wind and solar energy, enough to power more than 150,000 homes. Several other MREA members, including Great River Energy, are working to finalize Next ERA awards before Jan. 20, Moe said.

“Those programs are important to continue to carry out” to keep electricity reliable and affordable for MREA members, Moe said.

For Minnesota’s solar industry, the biggest concern aside from import tariffs on solar components — which have been in place for years and are expected to expand in Trump’s second term — is an early drawdown or outright repeal of the popular clean energy investment tax credit, which the IRA strengthened and extended, O’Grady said.

The ITC reduces by 30% the net cost of most eligible wind, solar and other clean energy investments that meet federal wage and apprenticeship requirements. For “energy community” projects benefiting areas historically dependent on the fossil-fuel industry, like the 710-megawatt Sherco Solar installation Xcel Energy is building to partially replace the output of the retiring Sherco coal-fired power plant, the potential credit is even larger.

Many ITC claims are made by private companies without public financial reporting obligations, making the credit’s cumulative impact on Minnesota’s economy more difficult to track than that of federal grants and loans, said Pete Wyckoff, deputy commissioner of energy resources for the Minnesota Department of Commerce.

But “the Department of Commerce and Minnesota Public Utilities Commission wouldn’t tolerate [state-regulated utilities like Xcel and Minnesota Power] not taking advantage of tax credits if eligible, just from a ratepayer perspective,” he added.

Private sector benefits

Beyond clean energy production, the IRA and other Biden-era legislation have catalyzed significant manufacturing investment in Minnesota.

Earlier this year, St. Cloud-based New Flyer was named “partner of choice” for more than $338 million in Federal Transportation Administration grants for low- or no-emissions buses enabled by the IIJA. New Flyer subsequently announced plans to ramp up hydrogen bus manufacturing at its central Minnesota plant.

Employment in Minnesota’s clean vehicle sector grew by 13% in 2023, led by a 14.4% jump in jobs related to electric vehicles, according to Clean Energy Economy Minnesota.

In September, Canadian solar module manufacturer Heliene announced the closing of a $50 million tax credit transfer as it works to open a second Minnesota plant in Rogers early next year. The company’s Mountain Iron facility has churned out solar modules since 2018.

Also this year, heavy equipment firm Cummins disclosed that it received $10.6 million from the U.S. Department of Energy’s IRA-expanded 48C tax credit program to support production of proton exchange membrane electrolyzers at its Fridley manufacturing plant. PEM electrolyzers use electricity to split water molecules and produce hydrogen, a critical feedstock for ammonia and other chemicals that can also be used as a carbon-free transportation fuel. When that electricity is produced by non-emitting resources like wind or solar, the resulting product is “green” hydrogen — in contrast to the methane-derived, carbon-intensive “gray” molecule that accounts for the vast majority of hydrogen used today.

“The IRA is why you’re seeing a huge buildout in all parts of the solar manufacturing and supply chain … and why you’re seeing the existence at all of a green hydrogen supply chain,” Wyckoff said.

The IRA and IIJA offer broader benefits for Minnesotans whose livelihoods don’t directly depend on the state’s rapidly growing green economy. That includes anyone who drives a plug-in electric vehicle — about 7% of all Minnesota car buyers in 2023 — and anyone considering energy-efficient home improvements, the enabling workforce for which accounts for 71.7% of all green jobs tracked by CEEM.

The IRA authorized up to $7,500 in federal income tax credits for qualifying buyers of new EVs and up to $4,000 in credits for qualifying used-EV buyers. Its $9 billion residential energy efficiency and electrification rebate program sets aside about $148.5 million for Minnesota properties, including up to $4,000 per household for qualifying retrofits and up to $14,000 for qualifying electric appliances or upgrades.

Meanwhile, the National Electric Vehicle Infrastructure program — authorized by the Infrastructure Investment and Jobs Act and administered by the Federal Highway Administration — has made four of its five anticipated annual disbursements to help build out public vehicle charging infrastructure, said Jon Solberg, assistant commissioner for sustainability, planning and program management at the Minnesota Department of Transportation. About $13.5 million remains to be disbursed in fiscal year 2026, Solberg said.

That funding wouldn’t come through until after Trump, a vocal EV skeptic, takes office. The new administration plans to eliminate the consumer EV tax credit through legislative action next year, Reuters reported last month, and Trump’s vow to rescind unspent IRA funding raises questions about the fate of the remaining NEVI funding.

But for now, it’s business as usual for MnDOT.

“[We] are proceeding with our plans to build chargers [and will] continue to do what we’ve been doing unless we are informed by [the Federal Highway Administration] not to do so,” Solberg said. “MnDOT feels strongly that a strong network of EV chargers across the state is important to provide consumers [with] options … and we will keep working with partners at the state and federal level to achieve those goals.”

The post Clean energy investments could be at risk in Trump’s second term appeared first on MinnPost.