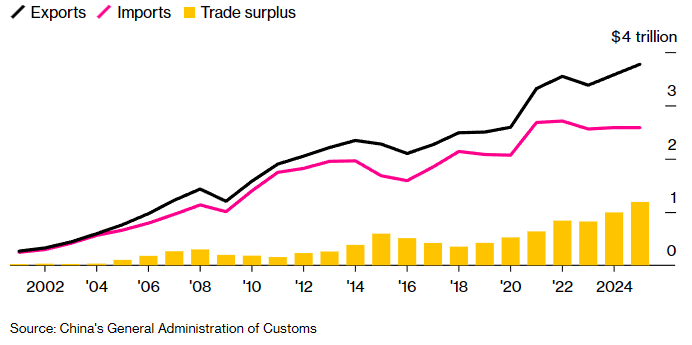

China reported record export figures for 2025 despite the unrest generated by the US President Donald Trump’s trade policies and tariffs. On 14th January (Wednesday), Beijing announced that it has the highest trade surplus in history, with $1.19 trillion in products and services exported abroad in relation to its imports, even adjusting for inflation, in a 20% rise from 2024. It is comparable to the GDP of oil-rich Saudi Arabia, one of the world’s top 20 economies.

China’s full-year trade surplus exceeded $1 trillion for the first time, shattering the previous high of $993 billion set in 2024. Last year, the nation’s monthly export surpluses exceeded $100 billion seven times. It was an indication that Trump’s tariff push has hardly impacted the country’s total trade with the rest of the world. China’s trade with other countries has now reached $6.48 trillion.

Wang Jun, the deputy director of China’s customs, lauded the number as “extraordinary and hard-won” in light of the “profound changes” and difficulties in international trade. He mentioned a spike in exports of robots, green technology, and products relating to artificial intelligence.

According to Wang, exports of electric vehicles, lithium batteries and photovoltaic products such as solar panels rose by 27%, while exports of high-tech goods, including expensive machine tools and industrial robots, grew at the rate of 13% each year. Building on the nation’s worldwide economic footprint, China has pushed its goods farther into outside markets and hedged businesses created during the initial trade conflict with Trump.

Chinese exports to other regions, particularly Southeast Asia and Latin America, increased even though trade with the US declined. The large surplus can be attributed to both a sluggish domestic market and a high demand for Chinese goods abroad as trade with foreign partners, especially the Indian subcontinent, Africa and Europe, expanded.

The country’s surplus is still widening, as it was $114.14 billion for December alone. The figure was the third-highest monthly surplus on record, trailing only January and June last year. The leaders of Beijing have undertaken an ambitious industrial program aimed at substituting domestic manufacturing for imports. Their objective has been to boost the country’s industrial sector self-reliance. China released a preliminary version of its five-year economic plan until 2030 in October and reiterated its aspirations for self-reliance.

Meanwhile, many Chinese families now have less money to spend on imported vehicles, cosmetics, and other items. Their spending on things made in their own country has also fallen. People who had invested in real estate have lost all of their life savings due to a housing market crisis since 2021, making it challenging for them to buy the deluge of products coming out of the nation’s industries. Hence, a large portion of those goods is exported.

A weak currency has also contributed to China’s trade surplus by making its imports more expensive and its goods less expensive in overseas markets. The government has hardly permitted the renminbi to recover from its drastic slide during the Covid-19 outbreak, despite a minor recovery in recent weeks. Due to extensive industry overcapacity and low domestic demand, China is witnessing deflation, a major dip in prices. Moreover, China’s exports are becoming even more desirable in global markets due to Western inflation.