Nifty index opened negative and cascaded throughout the session and stooped down to 25,860 levels. It broke all its immediate support levels and gave in to selling pressure to close near its lower band with losses of around 260 points. It formed a bearish candle on the daily frame and is forming lower highs – lower lows from the last three sessions. Now till it holds below 25,950 zones, weakness could be seen towards 25,700 then 25,600 zones while resistances have shifted lower to 26,000 then 26,150 zones.

File Image |

On option front, Maximum Call OI is at 26,100 then 26,200 strike while Maximum Put OI is at 25,700 then 25,500 strike. Call writing is seen at 26,000 then 26,100 strike while Put writing is seen at 25,900 then 25,700 strike. Option data suggests a broader trading range in between 25,400 to 26,400 zones while an immediate range between 25,700 to 26,100 levels.

S&P BSE Sensex index opened on a negative note and bears took charge from the initial hour as the index dragged sharply lower towards 84,100 zone. Sustained selling pressure persisted throughout the session with every minor bounce being sold into keeping bulls firmly on the back foot. Bears held a tight grip through the day resulting in a weak close below the 50 DEMA, further dampening near term sentiment. On the daily chart it formed a bearish candle and has been creating lower lows from the last four sessions, indicating that weakness may continue unless the index manages to reclaim and sustain above key hurdle levels. Now till it holds below 84,400 zones weakness could be seen towards 83,900 then 83,600 zones while hurdles have shifted lower to 84,500 then 85,700 zones.

File Image |

Bank Nifty index opened on a negative note but quick recovery was seen from lower levels towards 60,100 zones in the initial hour of the session. However it again failed to hold at higher zones and drifted lower towards 59,550 zones. It formed a bearish candle on the daily scale and is forming lower highs – lower lows from the last few sessions as selling pressure is seen at higher zones. Now till it holds below 59,750 zones some weakness could be seen towards 59,500 then 59,250 zones while on the upside hurdle is seen at 60,000 then 60,250 levels.

Nifty future closed negative with losses of 1.03% at 25,965 levels. Positive setup seen in IDFC First Bank, ICICI Bank, SBI Life, Solar Industries and BEL while weakness in Kaynes, RVNL, ONGC, Coforge, CDSL, Reliance, Biocon, Hindpetro, Ioc , Dr Reddy, Jubiliant foodworks, Trent, CG Power, TMPV and Bharti Airtel.

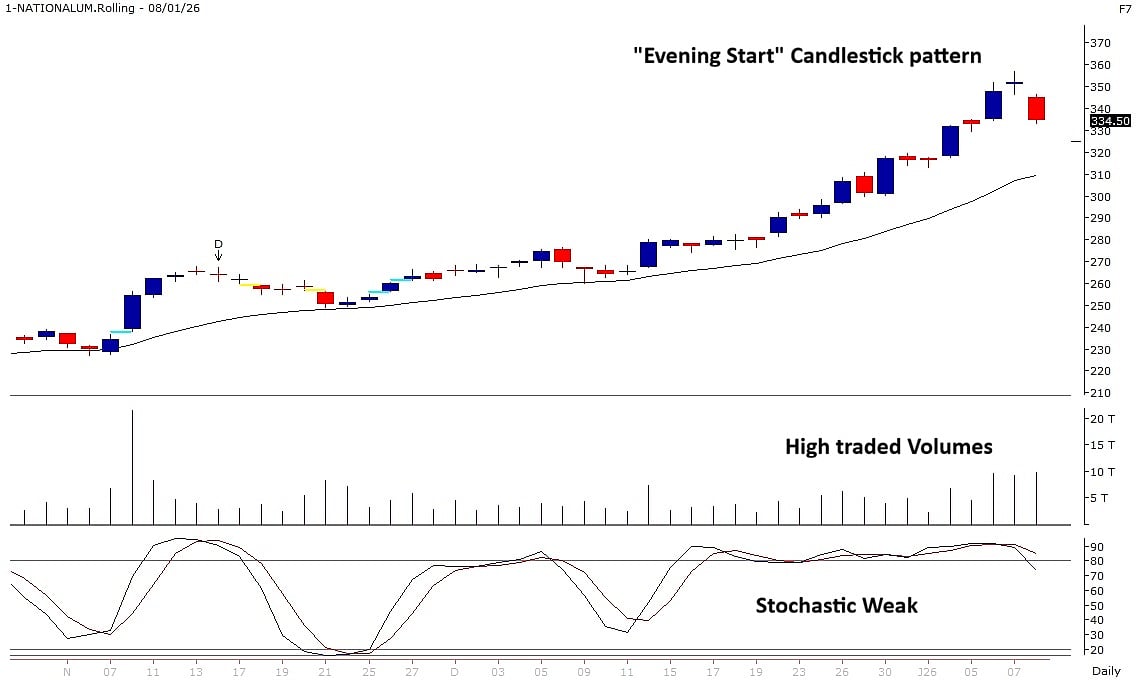

NATIONALUM

TECHNICAL CALL OF THE DAY:

Sell NATIONALUM 27th Jan FUT CMP 334 SL 342 TGT 315

Stock has formed an “Evening star” candlestick pattern suggesting a bearish reversal. The RSI indicator has given a bearish crossover to confirm the reversal.

File Image |

Top 5 Stocks:

Larsen & Toubro

The company has bagged an order from the Indian Army’s Corps of Electronics and Mechanical Engineers for overhaul, upgrade and obsolescence management of indigenous multi-rocket launcher systems. The partnership with the army aims to boost long-term operational availability and modernization of the Pinaka systems regiments currently in service. The program will focus on managing outdated components, upgrading critical sub-systems and providing sustained technical support to the army workshops.

MCX

The company’s wholly-owned subsidiary has received approval from the SEBI for the appointment of Rishi Nathany as the managing director and chief executive officer.

Granules India

The company has received tentative approval from the US health regulator for its generic amphetamine extended-release tablets indicated for treatment of attention deficit hyperactivity disorder, with eligibility of 180-day exclusivity.

BHEL

It has entered the semi-high speed rail market by beginning the supply of traction converters for the Vande Bharat sleeper train project

NMDC

Domestic iron ore price set to rise, NMDC is likely to increase iron ore prices by Rs 400/t in January. Global prices improving owing to restocking demand before Chinese Lunar holidays. At this price, NMDC prices are at 36% discount Additionally, domestic steel prices increased by Rs 4,500/t to Rs 51,900/t This provides opportunity to NMDC to increase prices Every Rs 100/t.